Understanding How Country of Origin Impacts Trade Policies

- Schulz Trade Law

- Nov 15, 2025

- 4 min read

Updated: Nov 25, 2025

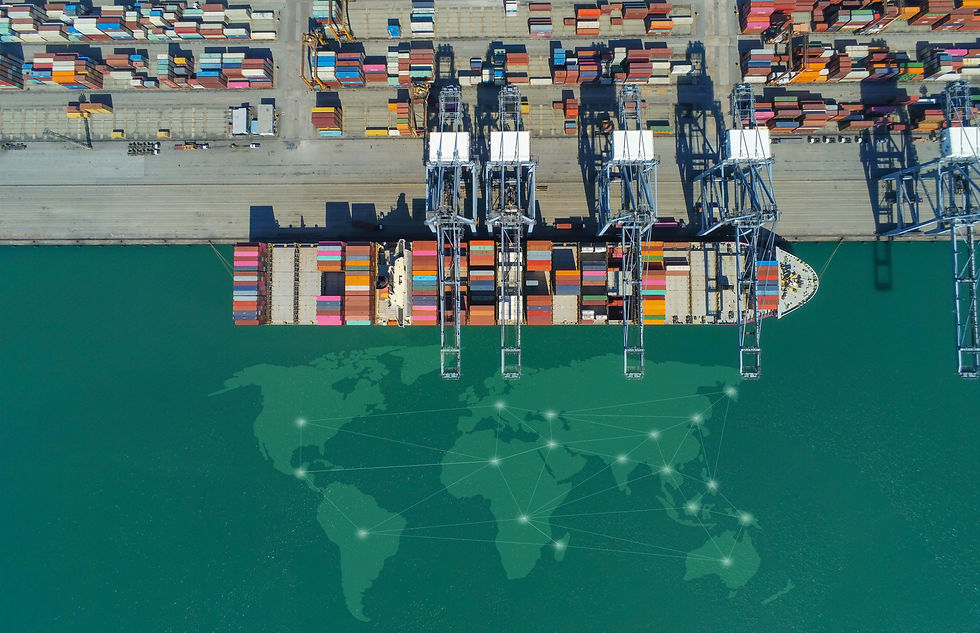

In the complex world of international commerce, the country of origin plays a crucial role in shaping trade policies. It influences tariffs, import restrictions, and regulatory compliance, affecting how goods move across borders.

Understanding this concept is essential for businesses, policymakers, and consumers alike. Here, we explore how the country of origin impacts trade policies, providing practical insights and examples to help navigate global trade effectively.

Schulz Trade Law Services include Country of Origin Determination.

The Role of Trade Policies in Global Commerce

Trade policies are the rules and regulations that govern the exchange of goods and services between countries. These policies determine tariffs, quotas, subsidies, and standards that affect international trade flows. Governments use trade policies to protect domestic industries, promote exports, and ensure national security.

Trade policies can be broadly categorized into:

Tariffs: Taxes imposed on imported goods to make them more expensive and less competitive compared to local products.

Quotas: Limits on the quantity of certain goods that can be imported or exported.

Subsidies: Financial support provided to local businesses to enhance their competitiveness.

Non-tariff barriers: Regulations such as safety standards, labeling requirements, and licensing that affect trade.

The country where a product is made often determines which trade policies apply.

For example, goods originating from countries with free trade agreements may enjoy reduced tariffs or exemptions. Conversely, products from countries under trade sanctions may face strict restrictions.

How Trade Policies Are Influenced by Country of Origin

Trade policies are closely linked to the country of origin because governments use this information to apply specific rules. The country of origin is the country where a product is manufactured, assembled, or substantially transformed. It is a key factor in customs declarations and trade compliance.

Here are some ways the country of origin influences trade policies:

Tariff Classification and Rates

Customs authorities apply tariffs based on the product’s origin. For instance, under the United States-Mexico-Canada Agreement (USMCA), goods made in member countries benefit from lower tariffs compared to those from non-member countries.

Trade Agreements and Preferences

Countries often enter into bilateral or multilateral trade agreements that grant preferential treatment to goods from partner nations. This can include reduced tariffs, simplified customs procedures, or exemption from quotas.

Anti-Dumping and Countervailing Duties

If a country believes that imported goods are priced unfairly low or subsidized, it may impose additional duties on products from specific countries to protect domestic industries.

Sanctions and Embargoes

Trade policies may restrict or prohibit imports from certain countries due to political or security reasons. These restrictions are strictly enforced based on the product’s country of origin.

Labeling and Compliance Requirements

Products must often carry labels indicating their country of origin. This transparency helps consumers make informed choices and ensures compliance with trade regulations.

Understanding these influences helps businesses plan their supply chains, pricing strategies, and market entry approaches effectively.

What is an example of country of origin?

To illustrate the concept of country of origin, consider a smartphone assembled in Mexico using components manufactured in China and South Korea. Determining the country of origin for trade purposes depends on where the product underwent its last substantial transformation.

In this case, if the assembly in Mexico significantly changes the product’s form, function, or use, Mexico would be considered the country of origin. This classification affects the tariffs applied when the smartphone is imported into the United States under the USMCA agreement.

Another example is textiles. If fabric is woven in India but cut and sewn into garments in Bangladesh, the country of origin might be Bangladesh if the sewing process is deemed the substantial transformation.

These examples highlight the importance of understanding the rules of origin, which vary by product and trade agreement. Businesses must carefully document and verify the origin to benefit from trade preferences and avoid penalties.

/di

Practical Recommendations for Businesses Navigating Trade Policies

For companies engaged in international trade, managing the impact of country of origin on trade policies is critical. Here are actionable recommendations:

Conduct a thorough origin analysis

Determine where your products undergo substantial transformation. Consult trade experts or legal advisors to ensure accurate classification.

Stay updated on trade agreements

Monitor changes in trade agreements and tariffs that may affect your supply chain. Use government resources and trade databases for the latest information.

Maintain detailed documentation

Keep records of manufacturing processes, supplier certifications, and shipping documents to prove the country of origin during customs inspections.

Leverage trade compliance software

Use technology to automate classification, track regulatory changes, and generate compliance reports.

Plan supply chains strategically

Consider sourcing and manufacturing locations that optimize tariff benefits and minimize trade barriers.

Train staff on trade regulations

Educate your team on the importance of country of origin and trade policy compliance to avoid costly mistakes.

By implementing these strategies, businesses can reduce risks, lower costs, and improve their competitiveness in global markets.

The Future of Trade Policies and Country of Origin Considerations

Trade policies continue to evolve in response to geopolitical shifts, economic trends, and technological advancements. The significance of the country of origin remains central, but new challenges and opportunities are emerging.

Digital trade and e-commerce

As online sales cross borders, verifying the country of origin for small shipments becomes more complex, requiring innovative solutions.

Sustainability and ethical sourcing

Consumers and regulators increasingly demand transparency about where products come from, pushing companies to disclose origin information more clearly.

Trade tensions and protectionism

Political conflicts may lead to stricter origin rules and increased scrutiny of supply chains.

Automation and AI in customs

Advanced technologies will enhance the accuracy and speed of origin verification, improving compliance and reducing delays.

Businesses that stay informed and adaptable will be better positioned to navigate these changes.

Understanding how the country of origin impacts trade policies is not just a regulatory necessity but a strategic advantage in the global marketplace.

For more detailed information on the topic, visit country of origin, or reach out to Schulz Trade Law today.

Comments